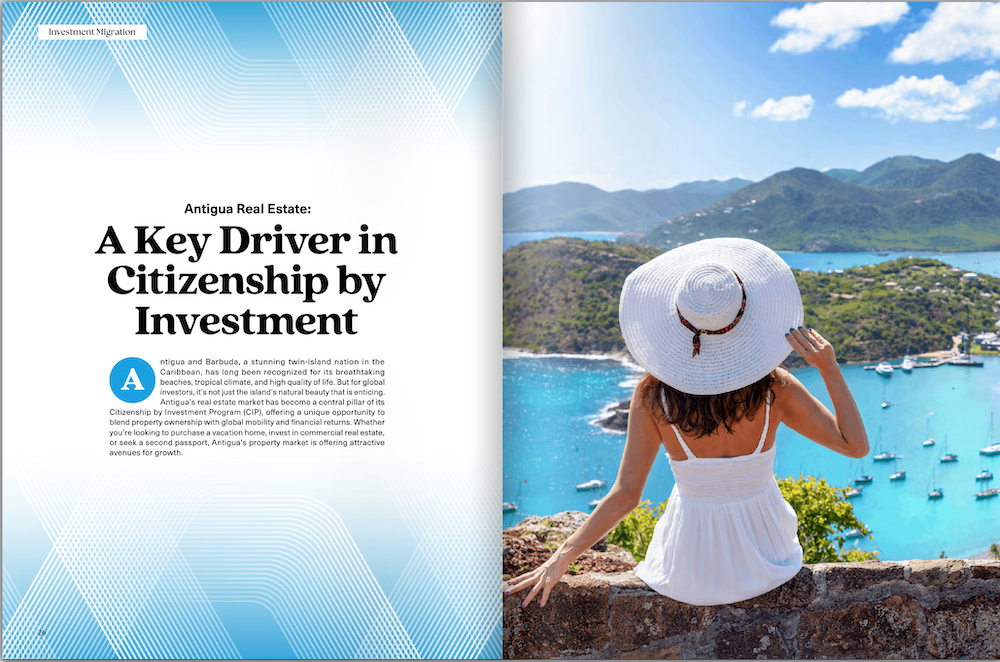

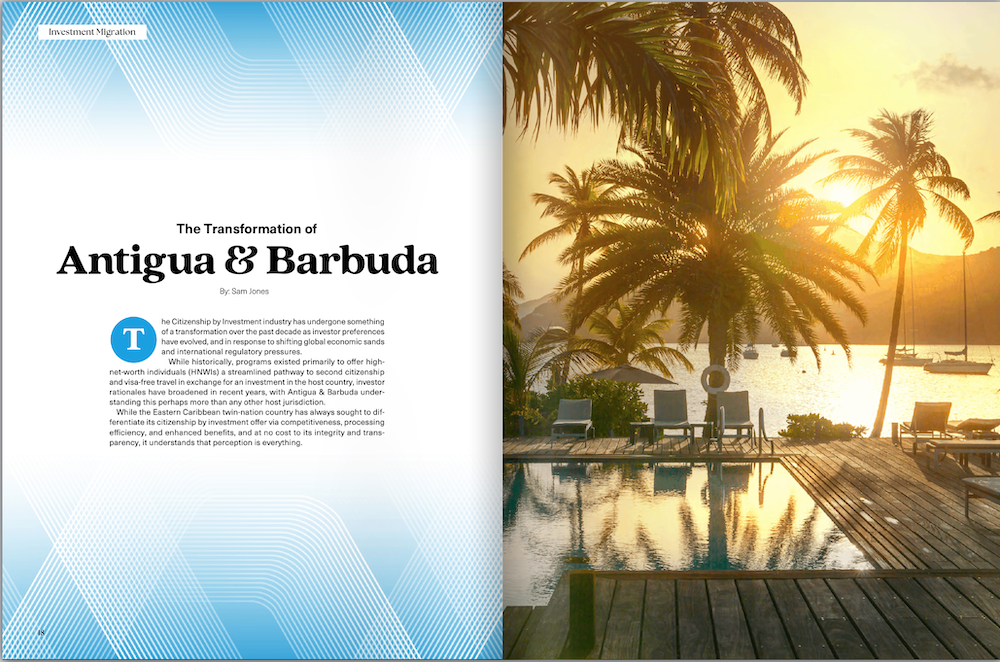

As global mobility and investment opportunities continue to evolve, so too do the initiatives designed to connect individuals with new residencies and second citizenships. CEO Insight is pleased to present this special report on investment migration, which highlights leading programs that underscore the strategic advantages of these opportunities. In this issue, we delve into the insights of key leaders from two distinguished markets: Malta and Antigua & Barbuda, each offering unique pathways to meet the aspirations of global citizens and investors alike.

Click below to view the supplement